UK banks to face higher standards for AI-driven loans

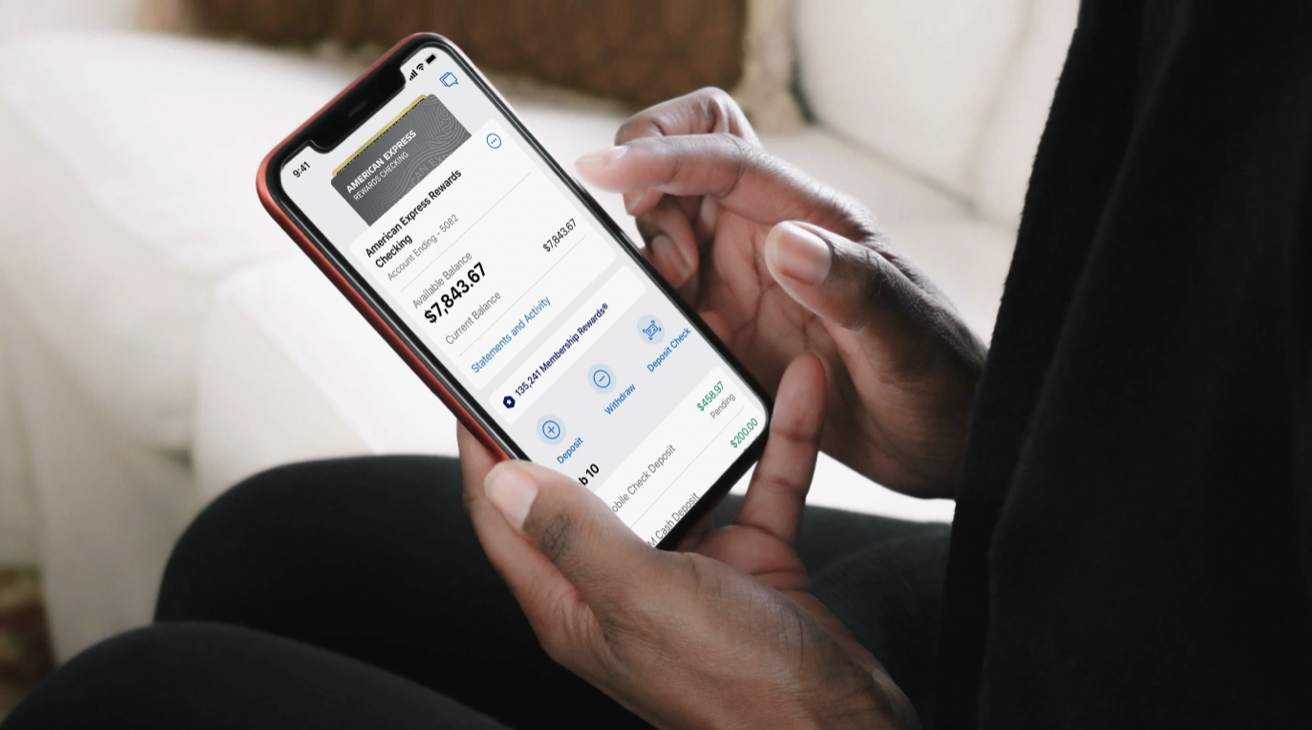

/Financial regulators told banks that they must prove that the use of AI in loan applications does not discriminate against minorities. The move follows growing concerns over systeming racism in banking.

Read More